Bank Bear Trap

Bank Bear Trap

We watched the regional bank industry experience a “Back to the Future” event. You remember the financial crisis when banks failed in 2008. Fortunately, it is not as bad as 2008, but perhaps it could have been avoided. Make sure you read the last section of this newsletter because there is some good news.

Janet Yellen, the treasury secretary, whose job is to monitor the bank industry, just a few days before the crisis unfolded on March 10th, spoke at a climate conference. Her presentation said that climate change would likely become a source of shocks to the financial system in the coming years(1). While she’s up there talking about the weather, the banking industry actually had a financial shock. In essence, there was an old-fashioned run on the banks because of facts, not rumors, getting out that some regional banks had more liabilities than assets.

In the SVB case, they were the first bank that experienced a known problem and had received so much money and deposits in 2020, 2021, and 2022 that they were out buying 10-year treasuries. Unfortunately, these 10-year treasuries, the yield was 1.5%(2). So, the Fed starts raising rates like they had talked about for a couple of years, really in 2022, and as most people know, when interest rates rise, the principal value of bonds drop. You may wonder why the banking industry was covering, in essence, one-day deposits with 10-year bonds. In other words, if your depositors wanted their money, you had to sell those bonds at a loss.

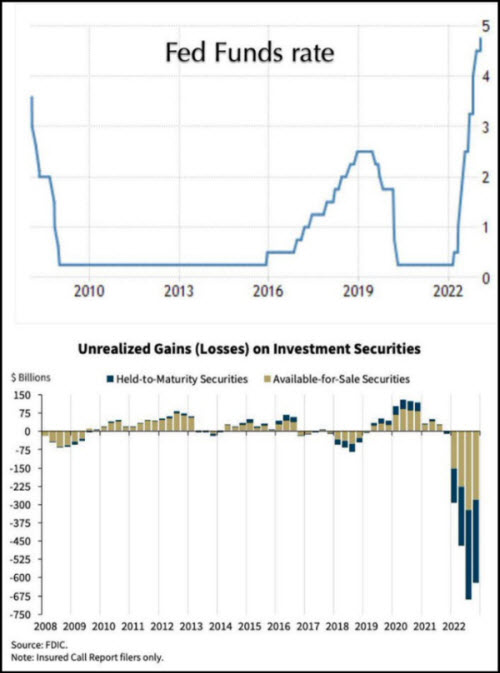

Please see the chart below from an article by David Sacks(3). His illustration better explains what’s going on with the banks than anything I’ve seen. This illustration shows the banking industry’s bond portfolio on the bottom and how much value it lost as the Fed raised rates(top of the chart). Losses are in hundreds of billions of dollars.

The Four Steps to the Banking crisis:

Step #1: The government prints and passes out free money to anybody who can fog a mirror, plus passes multi-trillion-dollar spending bills, which causes the worst inflation we’ve seen in 40 years.

Step #2: To combat inflation, the Fed raised rates very aggressively, driving down the principal value of the bonds banks had purchased.

Step #3: This made a few of the banks technically insolvent. If there was a run on the banks – oops.

Step #4: Yes, Mildred, there was a run on the banks.

No Soft Landing Here

Chairman Powell has been saying for months that they are hoping to have a soft landing, which equates to raising rates enough to lower and calm inflation without triggering a monetary crisis. Well, you can’t really say mission accomplished with this one!

Fortunately, the government will step in and ensure no depositors are hurt, regardless of the amount they hold at a bank. Banks will be forced to tighten up, and their costs will increase due to having bailed out the few affected banks. Banks will have less money or will be more reluctant to loan money. Currently, 30% of the loans in the country are done by regional banks(4). Do you expect more loans or fewer loans? I expect fewer loans, so we’ll have less economic activity. But hold on; there might be some good news for you.

Hidden Gem

It’s time to go long. Believe it or not, there’s a gem in the coal mine caused by the fed raising rates. It may be time for you to go long with certain investments. Specifically, I’m talking about fixed income, whether a bond for three to five years, a CD for one to four years, or even a multi-year guaranteed fixed annuity for two to seven years. It’s been many years since I’ve discussed this concept of going long. The last time was back in 2007 – 2009, and interest rates peaked in that business cycle. At that time, you could get 5- 7% on the above-mentioned investments and lock in a maturity date of 2 -5 years. Then we saw rates decrease for years.

Why do you need to go long? It’s not just football terminology. Going long refers to a maturity that exceeds one year. You go long if you think interest rates will decline or the economy is entering a period of uncertainty. Consider going long to lock in a decent return. I believe we’ll see rates start going back down in about a year and a half.

Right now, the sweet spot on these kinds of investments looks anywhere from one to four years. Of course, every investor’s situation is different. You can’t just willy-nilly and go out and take advice from a newsletter without consulting with a qualified investment advisor. As always, please feel free to call me with any questions.

Sincerely,

John Romano, CFP®

Office Phone #: 352-753-8590

Email: [email protected]

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years of experience in the financial field. John is a Registered Representative with Securities America, Inc. (a member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities are offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services are offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated. Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated. Guarantees are based upon the claims-paying ability of the insurance company. Past performance does not guarantee future results.

References:

(1) https://home.treasury.gov/news/press-releases/jy1325

(2) https://gulfnews.com/special-reports/biggest-bank-collapse-after-2008-global-recession-how-svb-spectacularly-failed-after-rate-heresy-becomes-reality-1.1678543355308

(3) https://thefederalist.com/2023/03/14/dont-blame-depositors-for-bank-failure-blame-biden-and-svb-management/

(4) https://www.marketwatch.com/articles/torsten-slok-economic-outlook-banks-aac85353?mod=search_headline